For the week of March 13 -- March 17, key data for investors to watch include U.S. February CPI, U.S. API and EIA crude inventory changes for the week ended March 10, U.S. jobless claims for the week ended March 11, and euro (1.0599, 0.0017, 0.16 percent) zone February CPI. The week's key events for investors include the ECB rate decision, a meeting of euro zone finance ministers, OPEC's monthly oil market report, the U.K. government's budget, minutes from the Bank of Japan's January monetary policy meeting and the Reserve Bank of Australia's economic bulletin.

① Monday, March 13. Key words: Eurozone finance ministers meeting

Economic indicators in the euro zone came in below expectations, showing no signs of improvement in the European economy. Euro zone retail sales fell 2.3% in January from a year earlier, Eurostat data showed on March 6, well below market expectations. Meanwhile, the investor sentiment index for the eurozone, released by research firm Centix on Wednesday, fell to -11.1 in March from -8 in February, indicating a more negative outlook for the eurozone economy. The report pointed out that the current eurozone inflation level is high, market confidence is not enough, the short term European economy will not be smooth recovery.

With the Eurogroup finance ministers meeting on March 13, investors need to watch what officials say, which may have an impact on future economic developments and the direction of markets.

② Tuesday, March 14 Key word: U.S. CPI for February, OPEC releases monthly crude oil market report

The US consumer price index (CPI) rose 6.4% in January from a year earlier, according to data released by the Bureau of Labor Statistics. Excluding volatile energy and food prices, the core CPI rose 5.6% from a year earlier, down from 5.7%.

Economists had expected the consumer price index to rise 6.2 per cent in January from a year earlier, with the core CPI rising 0.4 per cent from a month earlier and 5.5 per cent from a year earlier. The CPI shows the change in the prices consumers pay for goods and services. Many economists believe the core CPI is a more accurate predictor of future inflation than the headline CPI.

On March 14, U.S. CPI data for February is expected to remain relatively high.

Investors will also need to keep an eye on OPEC's monthly crude market report on March 14, which is expected to influence the future direction of oil prices.

③ March 15 (Wednesday) Keywords: US API and EIA crude oil inventory changes for week ended March 10, UK government budget report, Bank of Japan January monetary policy meeting minutes

U.S. crude inventories at API Cushing rose 24,000 barrels in the week ended March 2, compared with 483,000 barrels previously reported. API gasoline inventories rose 1.84 million barrels in the week to March 2 from -1.774 million barrels in the previous week. U.S. EIA crude inventories fell 1.694 million barrels in the week to March 3, versus expectations of a 1.6 million barrel increase and the previous 1.166 million barrel increase.

On March 15, the U.S. will report changes in API and EIA crude inventories for the week ended March 10, which are expected to continue to draw.

On March 15, the big event for investors to watch is the budget statement by British Finance Minister Jeremy Hunt. The UK is likely to continue tightening its public finances this year in preparation for the 2024 general election, according to market analysts. Mr Hunt looks set to keep control of the public finances in the budget, with no big tax cuts or spending increases until closer to the next election. A £30 billion (1.1952, 0.0030, 0.25%) windfall in Britain's battered public finances increases the pressure on Hunt to relax his fiscal stance. Sunak and Hunt have pledged to get Britain's 2.5 trillion pound debt down as a share of the economy within five years, which will limit Hunt's budget statement on March 15.

At 10:50 Beijing time on January 18, the Bank of Japan announced that it kept its forward guidance on interest rates unchanged and unexpectedly kept its bond Yield Curve control (YCC) decision. The boj kept the annual cap on ETF purchases unchanged at Y12tn, saying it would continue to buy JGBS on a large scale and respond flexibly to each maturity. Moreover, the BOJ will not hesitate to add easing if necessary. After the announcement of the resolution, the Bank of Japan resolution after the US dollar/yen (136.39, 0.2500, 0.18%) short-term cumulative pull up more than 240 points, hit a new high of four trading days.

On March 15, the Bank of Japan released the minutes of its January monetary-policy meeting, giving investors more details on officials' thinking.

④ Thursday, March 16 Key words: US jobless claims for Week ended March 11, RBA Economic Bulletin, ECB rate decision

On March 16, U.S. initial jobless claims for the week ended March 11 are expected

On March 16, the European Central Bank will hold its interest rate decision, which is the focus of the day for investors. Local time on March 8, the governor of the Bank of Italy, Giovano Visco said that he does not favor the European Central Bank to continue to raise interest rates, think its monetary policy should remain cautious. However, the market is pricing in a March rate hike.

Higher-than-expected inflation calls for more action from the European Central Bank. At the same time, signs of an economic recovery have given the European Central Bank confidence to continue raising interest rates. The euro zone's final services purchasing managers' index (PMI) came in at 52.7 percent in February, down from a preliminary reading of 53 percent but up from January's final reading of 50.8 percent, data showed.

Judging from the current statements of key officials of the European Central Bank, it is very likely that the ECB will continue to raise interest rates at the March monetary policy meeting, and a 50 basis point increase is already a high probability event. The European Central Bank is increasingly likely to raise interest rates by 50 basis points later this month after ECB President Christine Lagarde told the media that core inflation in the eurozone will remain high in the near term.

On March 16, the Federal Reserve of Australia will release the economic bulletin, from which we can understand the situation of the Australian economy, which may affect the trend of the Australian dollar (0.6595, 0.0006, 0.09%). Investors also need to pay attention to it.

⑤ Friday, March 17 Keywords: Eurozone February CPI

Eurozone CPI fell to an annual rate of 8.5 per cent in February from 8.6 per cent the previous month, as a sharp drop in energy prices offset a surge in almost all other areas, but still above expectations of 8.2 per cent in a market poll of economists. Although headline CPI is well below October's double-digit high, it continues to widen, fuelling concerns that the earlier surge in inflation has seeped into the economy through so-called second-round effects, making it harder to root out. Underlying CPI, which strips out volatile food and fuel prices, jumped to 5.6% in February from 5.3% the month before, well above expectations of stability.

In the energy sector, eurozone inflation is falling, but elsewhere it is proving stubborn. Service price growth, the largest component of core inflation, accelerated to 4.8% from 4.4%. That's a big worry because the industry is particularly sensitive to wage growth, which indicates accelerating labor costs.

On March 17, euro zone CPI for February will be released, and even if it falls slightly, chances are it will remain high.

CNC Machining, Laser Cutting, and Bending Services by Krosino

CNC Machining, Laser Cutting, and Bending Services by Krosino

Revolutionizing Manufacturing: Advantages of CNC Machining in Manufacturing

Revolutionizing Manufacturing: Advantages of CNC Machining in Manufacturing

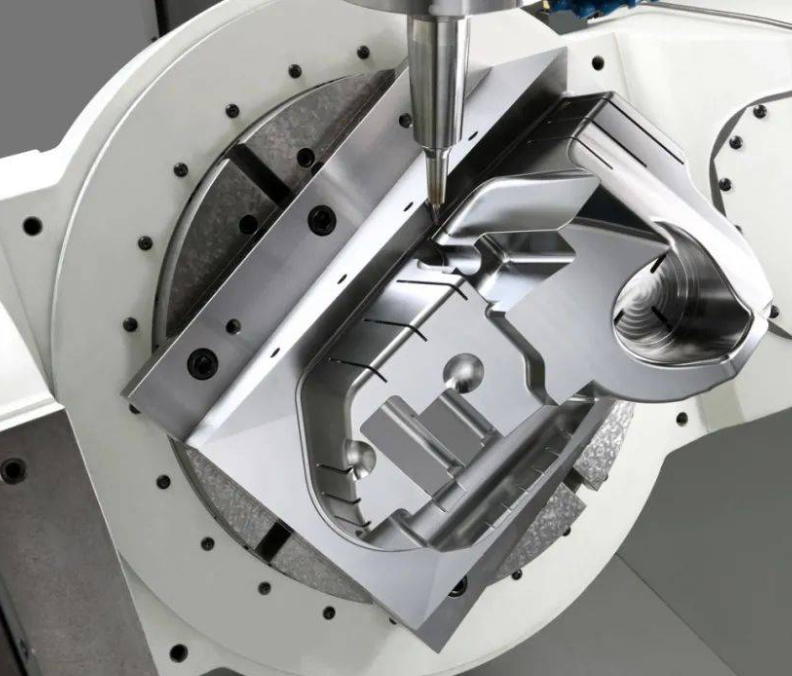

Unleashing Precision: Exploring CNC 5-Axis Machining

Unleashing Precision: Exploring CNC 5-Axis Machining

Krosino Company's CNC Machining Service for Global Customers

Krosino Company's CNC Machining Service for Global Customers